Today you will learn how to acquire residency in Mauritius, also we will dive in its advantageous taxation system on both a personal and corporative level.

Yes, it happens to me too when I hear the word “Mauritius”: I automatically think about the heavenly coloured sea and luxury resorts. But did you know that this fantastic feeling can last all year long? In fact, you can live in this paradise all year round and enjoy its enormous tax advantages.

A permanent summer paradise

This article is inspired by the story of one of our partners, who is currently living in Mauritius. This partner chose a country where he can enjoy that summer feeling all year round. A country which has victoriously bypassed some agreements. You are about to discover everything that this island has to offer.

Reasons in favour of Mauritius

We will start with the most obvious one: the climate. If there is one thing subjective and personal in this world, it is the perception a place’s climate. There are people who say they are having a bad day as soon as it becomes cloudy. It is something that cannot be explained; we are just aware of it and act accordingly.

It is no surprise that a country’s climate is a decisive factor for both emigration and immigration. Even in winter, from May to October, the average temperature on the island is 20°C, with July being the coolest month. If you are looking for a pleasant, tropical and warm climate, you should not cross Mauritius off your list of preferred destinations.

Another point in favour of Mauritius could be the fact that there are no poisonous reptiles or scary animals. More than one of Tax-Free Today’s clients has chosen not to emigrate to certain countries like Costa Rica or Thailand out of fear of certain animals.

Moreover, malaria does not exist in Mauritius and it is not necessary to get vaccinated to visit the country. However, the mosquito-transmitted diseases dengue and chikungunya are present on the island.

Another reason worth mentioning (which is fitting given the current situation) is that Mauritius is not involved in any war or armed conflict. As well as its high Human Development Index – of no less than 0.802 – Mauritius was ranked as the most peaceful African country by the Global Peace Index in 2019. The religions that exist on the island (Islam, Hinduism and Christianity) co-exist in harmony.

If we move on to the quality of life, Mauritius does not lose its appeal. The island has a French feel and the restaurants are tastefully decorated. In addition to public safety, the roads are in good condition, the streets are clean and the towns have a good public transport system.

In addition, the electricity supply, sewage system, water and air quality do not disappoint. Mauritius even has a better developed internet network than some European countries.

However, Mauritius is still an island

Many of us like to be able to move between countries and areas in a comfortable and flexible way. For those who stay in the European Union, this is entirely possible, because in the EU the borders are open (at least until a pandemic is announced again) and countries are attached to each other.

If you chose to live in Mauritius, this would not be the case. To enter the island, you have to take a plane from Frankfurt or Madrid, which takes about 11 hours. Since we are talking about Madrid, here is a comparison between the cost of living in the Spanish capital and Port Louis, the capital of Mauritius, or here between Port Louis and Frankfurt.

In short, the cost of living comparison between Port Louis and Frankfurt would look like this.

You would need about €4,301.25 to maintain the same standard of living as you could have with €2,437.16 (MUR 110,000) in Port Louis (assuming you live on rent in both cities). This calculation uses a Cost of Living + Rent Index to compare the cost of living in both cities.

On the other hand, the supply chain in Mauritius is much more limited than in Europe. Your online orders from Amazon in Mauritius (or any other supplier) will take longer to arrive, be less reliable and would be more expensive than those you could order in Spain, Portugal or practically any other country in Europe. Nevertheless, it is possible to find a wide variety of products in the local market and, of course, the smart thing to do is to shop (without VAT) when you visit Europe, for example.

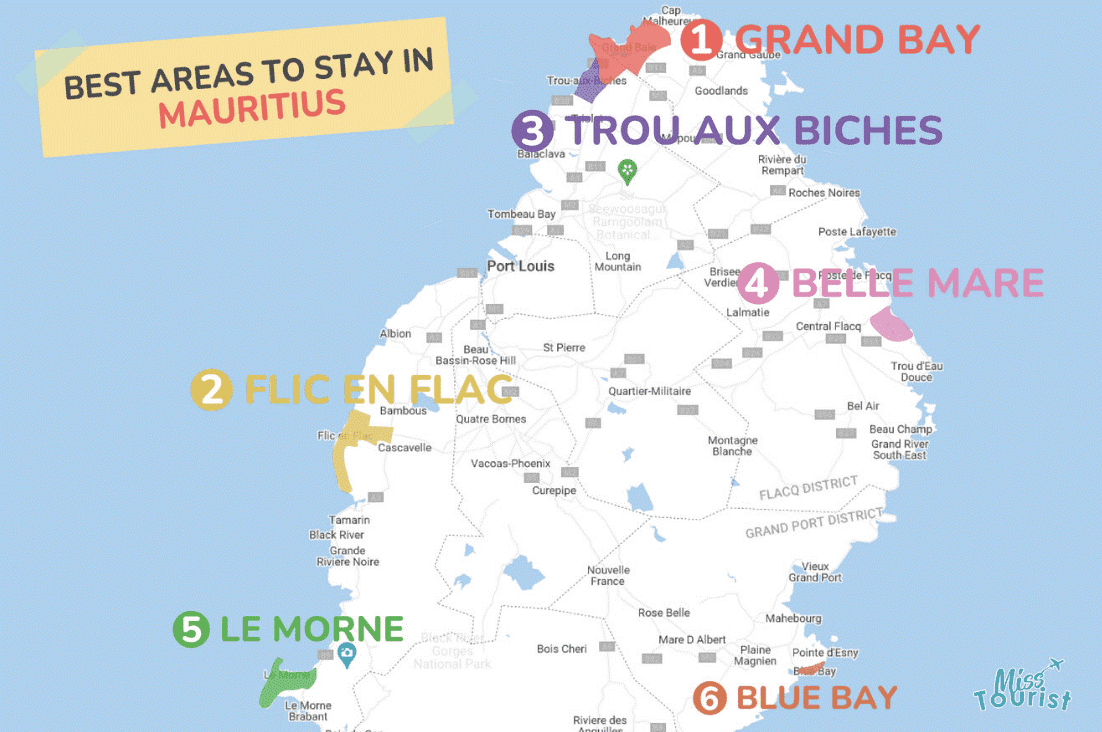

The island is very environmentally friendly. The country guarantees nature adventures for those who are looking for them and is home to ancient woodlands with indigenous plants and animals such as the dodo – a flightless bird that is now extinct. Moreover, the 6,500-hectare Black River Gorges National Park is just breathtaking (near No 5 Le Morne, in the southeast of the island):

Source: https://misstourist.com/where-to-stay-in-mauritius/

Tax in Mauritius

Now, let us talk about probably the most interesting aspect: taxes that you would pay whilst living in Mauritius. As you will soon discover, it is no coincidence that the island appears in our Denationalize.me emigration encyclopedia.

On a personal level, the following tax rates apply to annual net income (you should positively take into account the non-dom status that we will explain later on):

- 10% on the first MUR 700,000 (approx. EUR 15,000)

- 12,5% on income between 700,000 MUR and 975,000 MUR (approx. EUR 21,000)

- 15% on net income above MUR 975,000 (around EUR 21,000)

The fiscal year in Mauritius starts on the 1st of July and ends on the 30th of June.

On a corporate level, companies are currently subject to income tax on their net income at a fixed rate of 15%.

You can request a tax exemption on 80% of the tax collected in Mauritius on certain foreign income, again resulting in an effective tax rate of 3%. This applies to:

- Dividends from foreign sources

- Interest income

- Profits of a permanent foreign establishment

- Income from collective investment schemes and reinsurance

- Income from the leasing of ships and aircrafts

- Income from international fibre optic capacity

In general, capital gains are not taxed in Mauritius, which adds to the island’s appeal for all kinds of people. Moreover, Mauritius does not apply any withholding tax on dividends in the island. The standard VAT rate is 15% and the registration threshold is MUR 6,000,000 (about EUR 132,000).

Residency in Mauritius: A great opportunity for businessmen and investors in Africa

Mauritius is the Malta of the Indian Ocean, at least in regards to the fiscal system. As an English colony, Mauritius has a non-dom fiscal system, in which they look at the money coming into the country (Remittance Basis). The Mauritian system is similar to that of Malta.

Non-dom means “non-domiciled” and describes a status under common law. Under this system, foreign income is exempt from tax as long as they are not used in the country.

Contrary to the popular belief, not only does this apply to in-country remittance, but also to any cash or other money in general (cash withdrawals or credit card payments) used or deposited in the country.

Therefore, non-doms are never completely exempt from paying tax (except in Cyprus’ non-dom scheme, which works differently): You will always have to pay tax on money that you bring to the country to, at least, cover living expenses (and these costs must be credible.)

In any case, income or foreign investments used to sterol abroad are not taxed.

Being a tax resident in Mauritius

The 183 day rule also applies in Mauritius, so that if you want to be a tax resident there, you will need to spend half a year and a day there.

There is also an additional rule in place that allows you to be a tax resident if you have spent a total of 270 days on the island over the last 3 years. In other words, if, for example you have spent 80 days in 2021 and 190 days in 2022 in Mauritius, you would not need to spend anytime there in 2023 and you could automatically obtain a tax certificate.

The tax certificate, of course, is necessary if you want to benefit from Mauritius’ excellent network of double taxation treaties, which can offer many advantages, especially for investors.

Mauritius stands out for its 43 double tax treaties, which is unusual for a low-tax country.

As we have already mentioned in the beginning of this article, it is interesting to keep in mind that, since 2023, Spain does not consider Mauritius as a tax haven anymore. Therefore, Spaniards can directly relocate to this country and stop paying taxes in Spain.

Immigration costs in Mauritius

If you are convinced that Mauritius is the perfect place for you and your family (whether it is to live there or simply to set up a base), we will show you below the approximate costs for visas/ residency permits, starting a business and moving there.

Visa/ residency permit

- Professional/ retirement visa: between USD 2,500 and 3,000 + VAT per applicant

- Premium visa: between USD 1,500 and 2,000 + VAT per applicant

- Permission for each dependant: between USD 500 and 1,000 + VAT

- Immigration evaluation: between USD 200 and 500 (preliminary phase)

Moreover, you have to pay a processing fee of USD 1,000 to the government for occupancy and residency permits, and USD 400 per dependant. Medical examinations in Mauritius typically cost about MUR 5,000 (about 110 EUR).

In the case described above, the prices include help in compiling the documents and submitting them online, assistance in organising the medical examination and accompanying the applicant to the appointment with the Economic Development Board (EDB).

Starting a business

First year

- Accounting: USD 2,500 + VAT

- Administration: USD 4,775 + VAT

- Incorporation fee: includes bank account, registered office, company secretary, resident director and compliance fees.

From the second year on:

- Accounting: USD 1,600 + VAT

- Administration: USD 3,675 + VAT

- Registered office, company secretary, resident director, compliance fees, ROC and government fees

If you want us to help you move to Mauritius or discuss if it is really the best option for you, you can get in contact with us or book a Denationalize.me consultation directly.

Did you like our blog article?

Support us by purchasing our products and services. Or build up a passive income by recommending us as an affiliate! And don't forget to check out Christoph's travel blog christoph.today!

Secret Knowledge Video Course

Learn Everything that You Need to Know for a Life as a Perpetual Traveler

Watch Video CourseEncyclopedia Collection

Acquire Expansive Knowledge about Banking, Companies, Citizenships, and Emigration.

Order eBooks